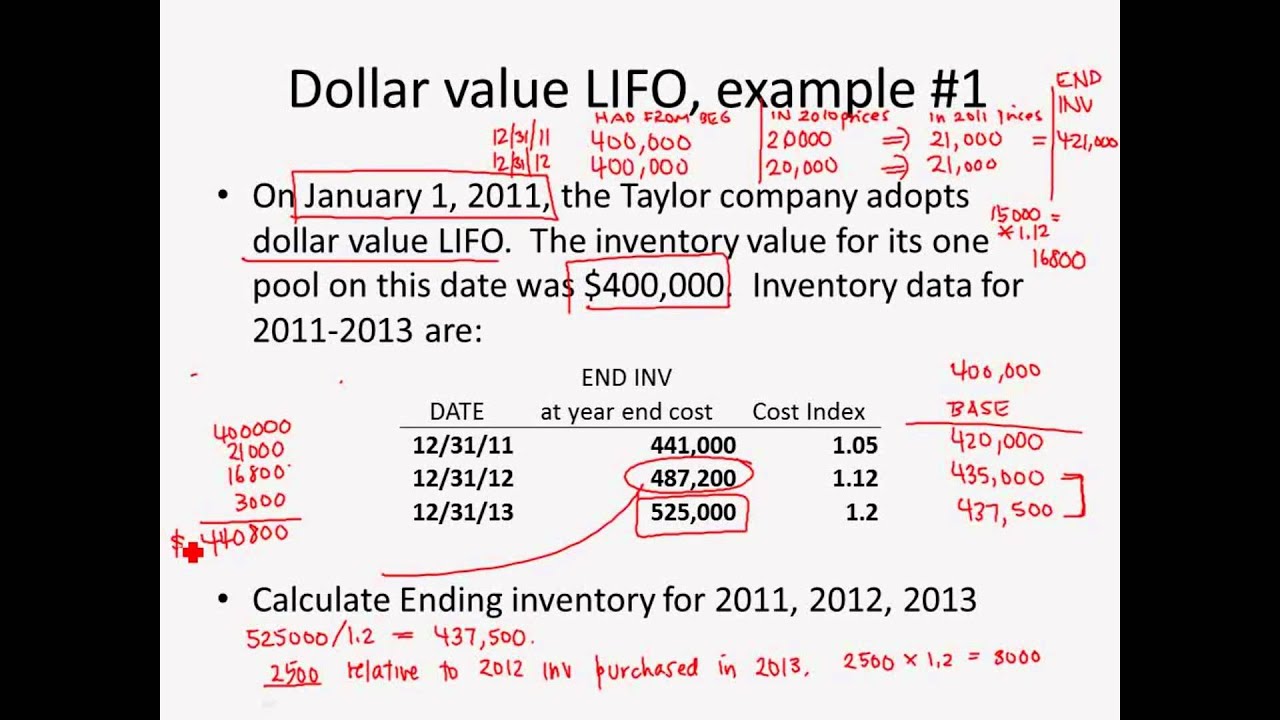

Dollar Value Lifo. # fifo retail method cost/retail ratio is applied to retail layer. You take the current year and divide it by that years specific multiple, and you get it at base year cost.

In an inflationary environment, it can more closely track the dollar value effect of cost of goods sold (cogs) and the resulting effect on net income than counting the inventory items in. Under dvl, you don’t view your inventory as a quantity of physical goods. In an inflationary environment, it can more closely track the dollar value effect of cost of goods sold (cogs) and the resulting effect on net income than counting the inventory items in terms of units.

Dollar Value LIFO I Intermediate Accounting I Lecture

Dollar value lifo uses this approach with all dollar figures rather than inventory units. In an inflationary environment, it can more closely track the dollar value effect of cost of goods sold (cogs) and the resulting effect on net income than counting the inventory items in terms of units. So dollar value lifo is all about the index rate (if i’m thinking of the right thing). It offers a different view of the balance sheet than other accounting methods such as first in, first out (fifo).